10++ How Can I Avoid Capital Gains Tax On Home Sale information

How can i avoid capital gains tax on home sale. The most effective commonly used strategy by real estate investors to avoid capital gains tax is known as a 1031 exchange also called a like-kind exchange. But how do I determine my capital gain. If youre married and filing jointly you can exclude up to a 500000 gain in the sale of your primary home. If it is an investment property you will have to follow the normal capital gains rules. This allows you to sell an. There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. Managing the Sale Date You could mitigate this tax burden by controlling the year in which title and possession passes out of your hands and therefore the year in which you report the capital. Well the gain on your sale is essentially the profit that youve made on the investment. If youre a single tax filer and you sell your primary home you can exclude up to a 250000 gain. Single If youre single 250000 of gains on the sale of a home are excluded from taxable income. Youve owned the home for at least two years Youve lived in the home for at least two years You havent exempted the gains on a home sale within the last two years. This exemption is only allowable once.

Avoid paying any capital gain taxes on your home sale. If you are single you can exclude as much as 250000 in profit from the sale of your primary residence. This means that if you buy a home for 350000 and 3 years later you sell it for 550000 the capital gain would be 200000. Special rules apply to the capital gains when you sell your primary residence. How can i avoid capital gains tax on home sale If your property isnt exempt from the capital gains tax here are a few strategies to minimize or reduce it. That is because the IRS has a primary residence exclusion for capital gains taxes. If you sell your home and buy another the capital gains exclusion requires you to have lived in the first home for at least two years of the five years prior to the sale. You can sell your primary residence and be exempt from capital gains taxes on the first 250000 if you are single and 500000 if married filing jointly. And because you bought the home more than two years ago you can walk away with your 212000 tax-free. This is under the 250000 limit so you wouldnt pay any capital gains tax. The property has to be your principal residence you live in it. Generate an income stream for the duration of your life and even your childrens lives with the proper structuring. Diversification of investment assets.

How Do I Avoid Capital Gains Tax When Selling A House Millionacres

How Do I Avoid Capital Gains Tax When Selling A House Millionacres

How can i avoid capital gains tax on home sale Your taxable profit on your recent sale is 212000.

How can i avoid capital gains tax on home sale. For at least two of the five years before the sale you or your spouse must have used the home as your primary residence. The home is your primary residence. If you meet the ownership and use tests you can exclude up to 250000 if you are unmarried or 500000 if you are married and filing a joint return.

If the property you sold is your primary residence you will most likely pay very little or no tax. Heres how you can qualify for capital gains tax exemption on your primary residence. How can I reduce capital gains tax on a property.

You may be able to reduce the amount of capital gain on the sale of your residence due to your job change even though you do not meet the two-year. Potentially avoid hefty estate taxes since its technically no longer a.

How can i avoid capital gains tax on home sale Potentially avoid hefty estate taxes since its technically no longer a.

How can i avoid capital gains tax on home sale. You may be able to reduce the amount of capital gain on the sale of your residence due to your job change even though you do not meet the two-year. How can I reduce capital gains tax on a property. Heres how you can qualify for capital gains tax exemption on your primary residence. If the property you sold is your primary residence you will most likely pay very little or no tax. If you meet the ownership and use tests you can exclude up to 250000 if you are unmarried or 500000 if you are married and filing a joint return. The home is your primary residence. For at least two of the five years before the sale you or your spouse must have used the home as your primary residence.

How can i avoid capital gains tax on home sale

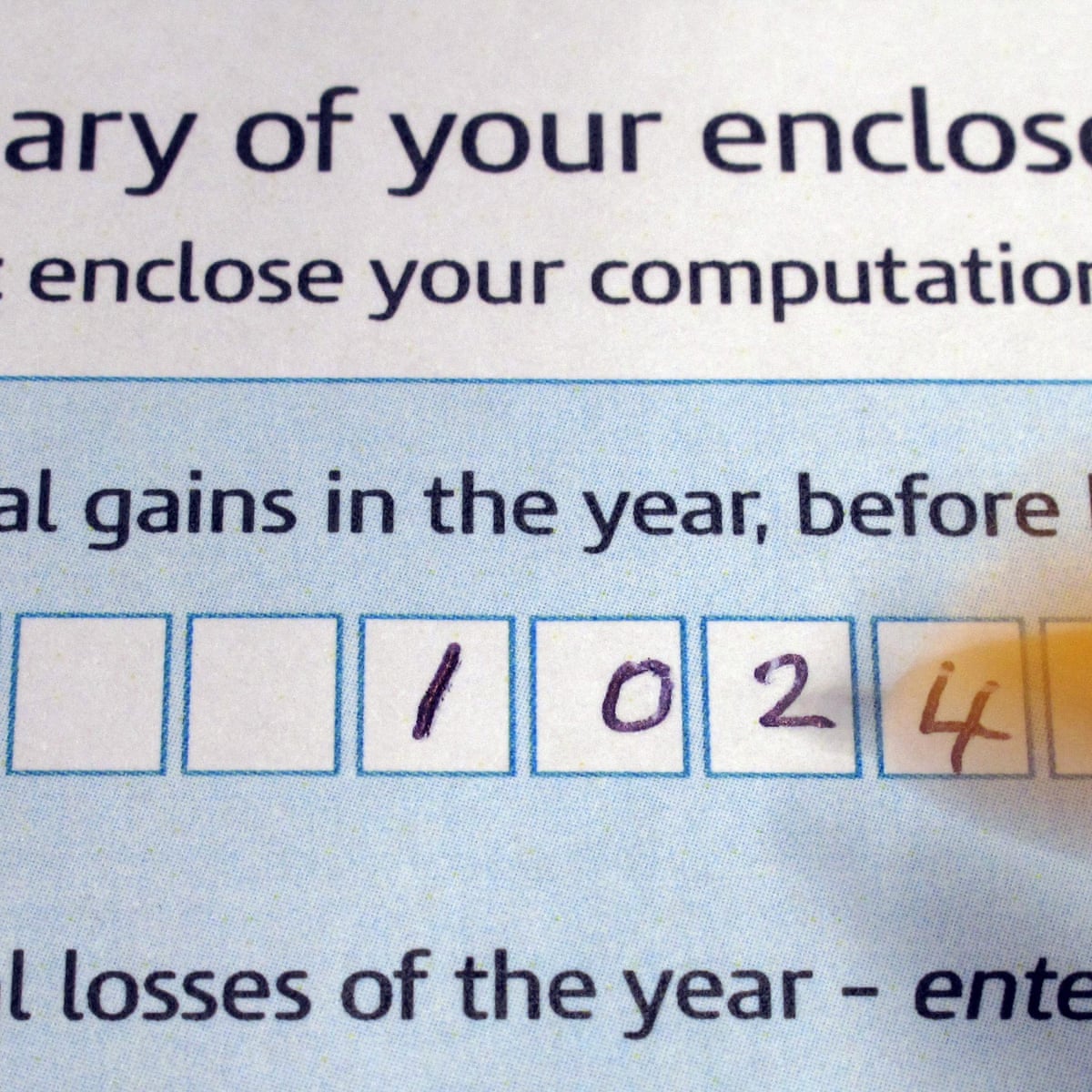

I Want To Sell My Uk Home Can I Avoid Capital Gains Tax Capital Gains Tax The Guardian

I Want To Sell My Uk Home Can I Avoid Capital Gains Tax Capital Gains Tax The Guardian