23+ How Do You Remove A Repossession From Your Credit Report ideas

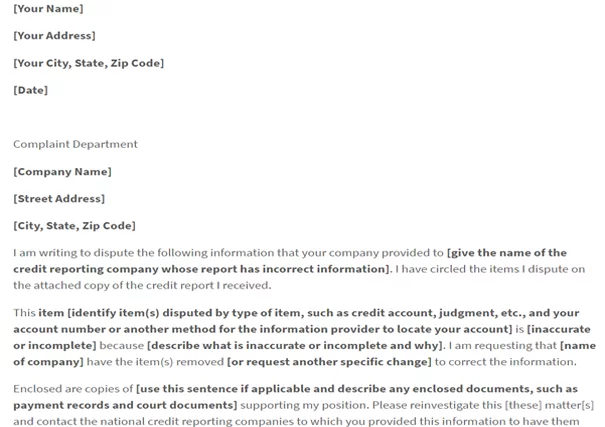

How do you remove a repossession from your credit report. However a simple it is dragging down my credit isnt enough. In the meantime we have a few steps you can take to try to remove a collections account from your credit report. Data from these three bureaus feed your FICO score which lenders check before giving you a. A repossession will only drop off from your credit report after seven years then it will be like it never happened. Its rare to have creditors or credit reporting agencies remove a charge-off from your credit report. While credit repair is hardly a guarantee filing a credit report dispute may allow you to remove an erroneous or unsubstantiated repossession mark from your credit report. The FCRA lets you dispute any item on your credit report that you believe is incorrect. If you are successful in getting it removed early. Dispute the Repossession on Your Credit Report. In the dispute letter make sure you provide evidence that backs up your claim. They will seek to determine if the repossession followed legalities in your state. Youll submit your complaint and request to have it removed from your credit report along with your justification.

They know the ins-and-outs of removing repos from credit reports. Here are a few steps you can take. If you want to remove the repo from your reports and it was legitimate youre probably going to be stuck with it. To attempt to remove a repossession from your credit report youll need to initiate a credit disputeand prove to the credit bureaus that the repossession is fraudulent outdated or otherwise inaccurate. How do you remove a repossession from your credit report If you notice other inaccurate negative marks you can list them in your dispute letter and provide proof for those too. You can dispute a repossession on your credit report with the credit bureaus the same as you can any other item. If the lender cant verify that the repossession is valid or fails to answer the dispute within 30 days then they must remove it from your credit report. Another thing you can do is file a dispute with the credit bureaus. If the loan wasnt reinstated and you still owe the lender they may remove the repossession from your credit report in. You could also get the negative item removed by disputing the repossession with the three major credit bureaus Experian TransUnion and Equifax. Assuming that doesnt happen the lender is likely going to proceed with reporting the repossession to the three major credit reporting bureaus. The easiest way to remove a repossession from your credit is by hiring a credit repair company like Credit Saint. Work directly with the lender.

How To Remove A Repossession From Your Credit Report Lexington Law

How To Remove A Repossession From Your Credit Report Lexington Law

How do you remove a repossession from your credit report Negotiation with the lender.

How do you remove a repossession from your credit report. The bottom line is that there are ways to have negative marks removed from your credit report and a specialist in credit repair is going to be your best bet. If the repo was legal they will try to work with you to find solutions acceptable to you and the lender. The steps for negotiating a charge-off settlement include.

In order to remove a repo you have to submit a dispute either electronically or in writing to the credit bureau that reported it. You must dispute the entry with each of the credit bureaus to make sure the removal is complete across the board. You can dispute a repossession or you can try to negotiate with the creditor to remove it early.

If the lender fails to respond or verify the information it must be removed from your credit report within 30 days of the dispute. The Federal Trade Commission offers a free sample letter consumers can use as a reference. If you want to remove the repossession from your credit report youll have to dispute it with the credit bureaus.

Equifax Transunion and Experian. Unfortunately the process for getting anything removed from your credit report is far from simple. A charge-off is when youve stopped paying off a debt and the creditor records your account as a lost cause.

Do Your Research. It is possible to get a repossession removed from your credit report if you negotiate with the lender successfully file a dispute or hire a credit repair company. After this happens the consumer is limited to three courses of action to remove the repossession record.

Once a repossession has happened removing it from your credit reports is difficult. This leaves credit repair as the only potential method for removing the repo from your credit report before its expiration date. There are two potential ways to remove a repossession from your credit report before the law requires it to be deleted.

Check your credit reportand review the. There are ways to remove accounts from credit reports but it involves proving that the account is inaccurate or outdated. Write a letter to any one of the credit bureaus.

Keep track of your collection account by getting copies of all your credit reports. This lets you see whats being reported by the three major credit bureausand how it impacts your score. How to file a dispute letter.

You can either pay the charged-off account in full or settle the debt.

How do you remove a repossession from your credit report You can either pay the charged-off account in full or settle the debt.

How do you remove a repossession from your credit report. How to file a dispute letter. This lets you see whats being reported by the three major credit bureausand how it impacts your score. Keep track of your collection account by getting copies of all your credit reports. Write a letter to any one of the credit bureaus. There are ways to remove accounts from credit reports but it involves proving that the account is inaccurate or outdated. Check your credit reportand review the. There are two potential ways to remove a repossession from your credit report before the law requires it to be deleted. This leaves credit repair as the only potential method for removing the repo from your credit report before its expiration date. Once a repossession has happened removing it from your credit reports is difficult. After this happens the consumer is limited to three courses of action to remove the repossession record. It is possible to get a repossession removed from your credit report if you negotiate with the lender successfully file a dispute or hire a credit repair company.

Do Your Research. A charge-off is when youve stopped paying off a debt and the creditor records your account as a lost cause. How do you remove a repossession from your credit report Unfortunately the process for getting anything removed from your credit report is far from simple. Equifax Transunion and Experian. If you want to remove the repossession from your credit report youll have to dispute it with the credit bureaus. The Federal Trade Commission offers a free sample letter consumers can use as a reference. If the lender fails to respond or verify the information it must be removed from your credit report within 30 days of the dispute. You can dispute a repossession or you can try to negotiate with the creditor to remove it early. You must dispute the entry with each of the credit bureaus to make sure the removal is complete across the board. In order to remove a repo you have to submit a dispute either electronically or in writing to the credit bureau that reported it. The steps for negotiating a charge-off settlement include.

How To Remove A Repossession From Your Credit Report

How To Remove A Repossession From Your Credit Report

If the repo was legal they will try to work with you to find solutions acceptable to you and the lender. The bottom line is that there are ways to have negative marks removed from your credit report and a specialist in credit repair is going to be your best bet. How do you remove a repossession from your credit report.