29++ Bank Regulation And Supervision Around The World A Crisis Update Ideas

Bank regulation and supervision around the world a crisis update. Many observers pointed out weaknesses in regulation and supervision in the run-up to the crisis see for example Caprio Demirguc-Kunt and Kane 2010 Dan 2010 Levine 2010 and Barth Caprio and Levine 2012. Bank regulation and supervision around the world. The paper finds significant differences between crisis and non-crisis countries in several aspects of regulation and supervision. R Caprio Jr G Levine R. A crisis update Toggle navigation. The paper finds significant differences between crisis and non-crisis countries in several aspects of regulation and supervision In particular crisis countries a had less stringent definitions of capital and lower actual capital ratios b faced fewer restrictions on non-bank activities c were less strict in the regulatory treatment of bad loans and loan losses and d had weaker incentives for the private sector to monitor banks. In the early 2000s the World Bank created a global database of bank regulation and supervision. R Caprio Jr G Levine R. The second update of the database was issued in 2003 the third in 2007 and the fourth in 2012. Bank regulation and supervision around the world. Download with Google Download. Specifically comparing regulatory and supervisory practices before and after the global crisis the paper finds relatively few changes.

Second what aspects of regulation and supervision changed significantly during the crisis period. First were there significant differences in regulation and supervision between crisis and non-crisis countries. Journal of Financial intermediation 132 205-248. This paper summarizes the latest update of the World Bank Bank Regulation and Supervision Survey. Bank regulation and supervision around the world a crisis update One can point to the global banking crisis of 2007-2009 the banking problems still plaguing many European countries in 2013 and the more than 100 systemic banking crises that have devastated economies around the world. The most recent survey was started in 2017 and completed in 2019. World Bank Policy Research Working Paper No 6286 Washington DC. Bank regulation and supervision. In this study using the World Banks Bank Regulation and Supervision Survey BRSS data we draw insights about the bank regulatorysupervisory styles illustrate the differences in regulationsupervision among crisis non-crisis and BRICS countries and highlight the ways in which bank regulation and supervision has changed during the crisis period. Bank regulation and supervision has become subject of vigorous debates during the global financial crisis. In particular crisis countries a had less stringent definitions of capital and lower actual capital ratios b faced fewer restrictions on non-bank activities c were less strict in the regulatory treatment of bad loans and loan losses and d had weaker incentives for the private sector to monitor banks. The chapter and the underlying paper Čihák Demirgüç-Kunt Martínez Pería and Mohseni-Cheraghlou 2012 use the responses from the World Banks Banking Regulation and Supervision Survey accompanying the Global Financial Development Report and performs an econometric analysis comparing countries that ended up in banking crises and those that managed to avoid them. It shows that regulatory capital increased but some elements.

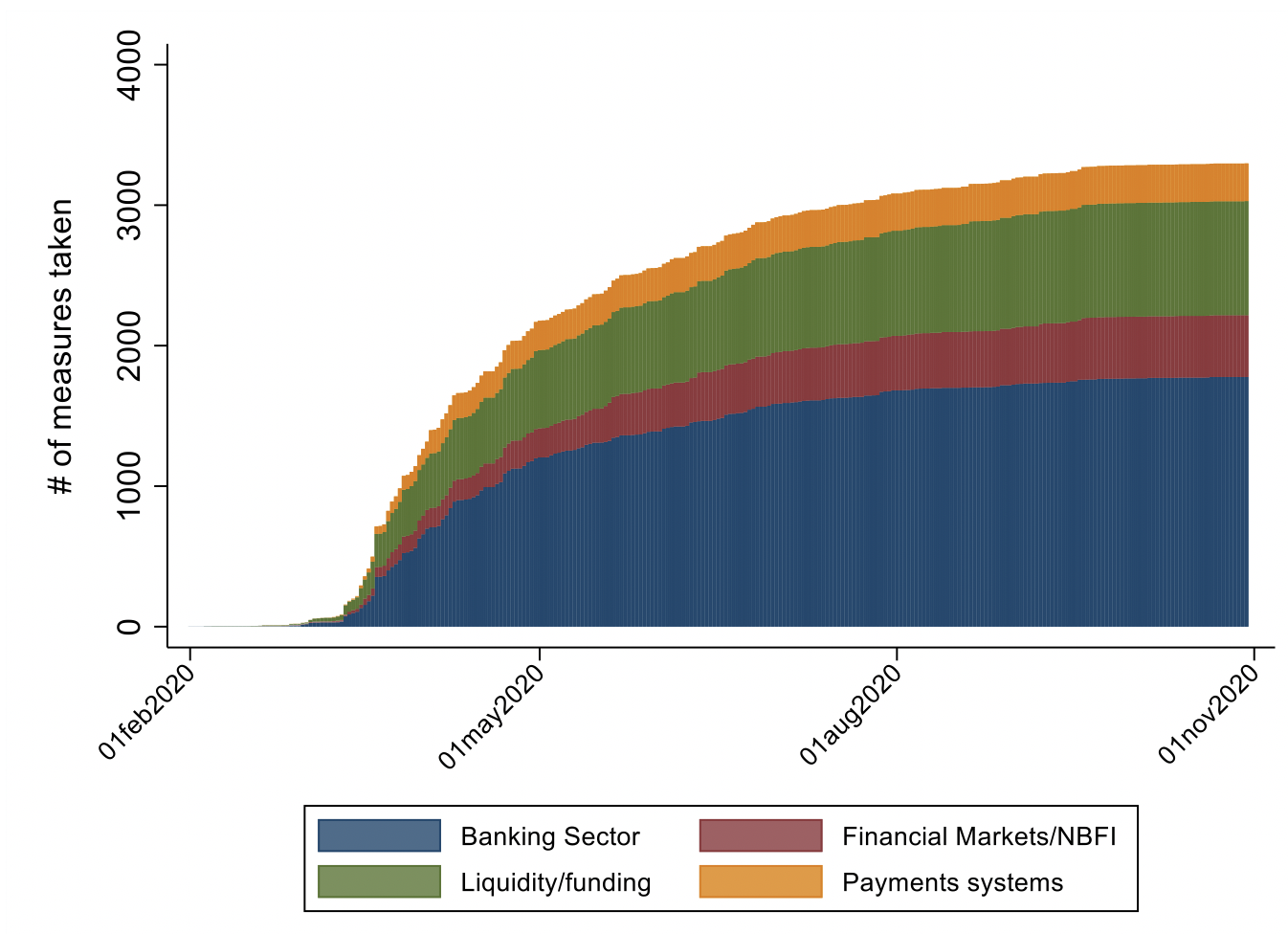

Taking Stock Of The Financial Sector Policy Response To Covid 19 Around The World Vox Cepr Policy Portal

Taking Stock Of The Financial Sector Policy Response To Covid 19 Around The World Vox Cepr Policy Portal

Bank regulation and supervision around the world a crisis update Bank Regulation and Supervision.

Bank regulation and supervision around the world a crisis update. The paper explores and summarizes the evolution in bank capital regulations capitalization of banks market discipline and supervisory power since the global financial crisis. The paper finds significant differences between crisis and non-crisis countries in several aspects of regulation and supervision. Motivating an investigation of bank regulation and supervision is easy.

SSRN Electronic Journal 2000. This paper presents the latest update of the World Bank Bank Regulation and Supervision Survey and explores two questions. In particular crisis countries a had less stringent definitions of capital and lower actual capital ratios b faced fewer restrictions on non-bank activities c were less strict in the regulatory treatment of bad loans and loan losses and d had weaker incentives for the private sector to monitor banks.

Bank regulation and supervision Barth J. With 189 member countries staff from more than 170 countries and offices in over 130 locations the World Bank Group is a unique global. Leadership organization and history.

This paper presents and examines he World Banks 201112 Bank Regulationt and Supervision Survey BRSS. Bank Regulation and Supervision a Decade after the Global Financial Crisis Bank Regulation and Supervision Survey The Bank Regulation and Supervision Survey is a unique source of comparable economy-level data on how banks are regulated and supervised around the world. Capital ratios increased primarily among non-crisis countries deposit insurance schemes became more generous and some reforms were introduced in the area of bank governance and bank resolution.

Bank Regulation and Supervision Around the World. The survey is an updated and substantially expanded version of earlier surveys of the same name released by the World Bank in 2001 2003 and 2007. In particular crisis countries a had less stringent definitions of capital and lower actual capital ratios b faced fewer restrictions on non-bank activities c were less strict in the regulatory treatment of bad loans and loan losses and d had weaker incentives for the private sector to monitor banks.

The paper finds significant differences between crisis and non-crisis countries in several aspects of regulation and supervision. Bank regulation and supervision around the world. Countries around the world and the changes brought about by the crisis.

The Bank Regulation and Supervision Survey is a unique source of comparable economy-level data on how banks are regulated and supervised around the world.

Bank regulation and supervision around the world a crisis update The Bank Regulation and Supervision Survey is a unique source of comparable economy-level data on how banks are regulated and supervised around the world.

Bank regulation and supervision around the world a crisis update. Countries around the world and the changes brought about by the crisis. Bank regulation and supervision around the world. The paper finds significant differences between crisis and non-crisis countries in several aspects of regulation and supervision. In particular crisis countries a had less stringent definitions of capital and lower actual capital ratios b faced fewer restrictions on non-bank activities c were less strict in the regulatory treatment of bad loans and loan losses and d had weaker incentives for the private sector to monitor banks. The survey is an updated and substantially expanded version of earlier surveys of the same name released by the World Bank in 2001 2003 and 2007. Bank Regulation and Supervision Around the World. Capital ratios increased primarily among non-crisis countries deposit insurance schemes became more generous and some reforms were introduced in the area of bank governance and bank resolution. Bank Regulation and Supervision a Decade after the Global Financial Crisis Bank Regulation and Supervision Survey The Bank Regulation and Supervision Survey is a unique source of comparable economy-level data on how banks are regulated and supervised around the world. This paper presents and examines he World Banks 201112 Bank Regulationt and Supervision Survey BRSS. Leadership organization and history. With 189 member countries staff from more than 170 countries and offices in over 130 locations the World Bank Group is a unique global.

Bank regulation and supervision Barth J. In particular crisis countries a had less stringent definitions of capital and lower actual capital ratios b faced fewer restrictions on non-bank activities c were less strict in the regulatory treatment of bad loans and loan losses and d had weaker incentives for the private sector to monitor banks. Bank regulation and supervision around the world a crisis update This paper presents the latest update of the World Bank Bank Regulation and Supervision Survey and explores two questions. SSRN Electronic Journal 2000. Motivating an investigation of bank regulation and supervision is easy. The paper finds significant differences between crisis and non-crisis countries in several aspects of regulation and supervision. The paper explores and summarizes the evolution in bank capital regulations capitalization of banks market discipline and supervisory power since the global financial crisis.

Pdf International Standards For Strengthening Financial Systems Can Regional Development Banks Address Developing Countries Concerns

Pdf International Standards For Strengthening Financial Systems Can Regional Development Banks Address Developing Countries Concerns